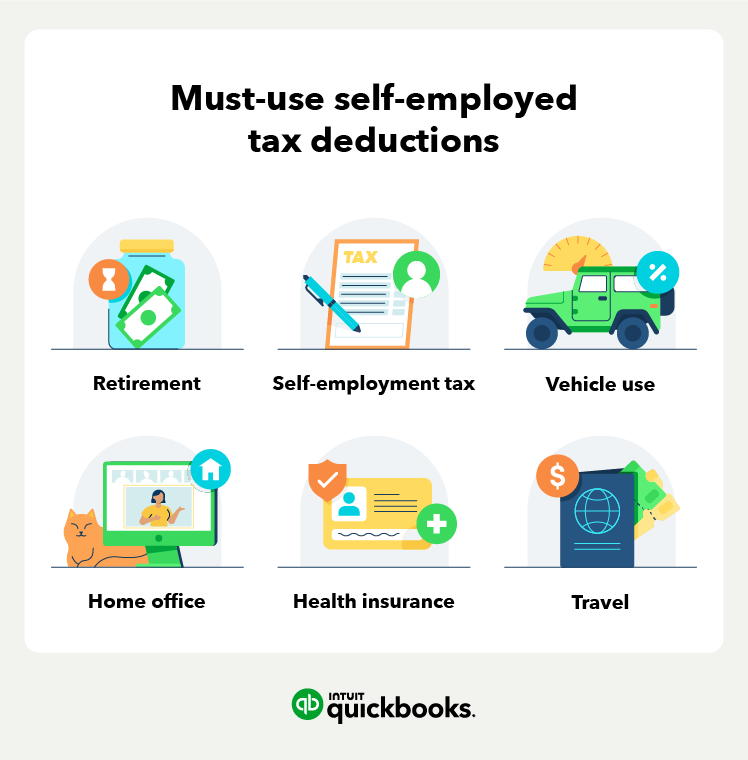

Home Office Deduction 2024 Self Employed Deduction – If you worked remotely in 2023, you may be curious about the home office deduction. Here’s who qualifies for the tax break this season, according to experts. . The home office tax deduction is an often overlooked tax break for the self-employed that covers expenses for the business use of your home, including mortgage interest, rent, insurance .

Home Office Deduction 2024 Self Employed Deduction

Source : quickbooks.intuit.comHome Office Deduction for Small Business Owners | Castro & Co. [2024]

Source : www.castroandco.comThe Home Office Deduction TurboTax Tax Tips & Videos

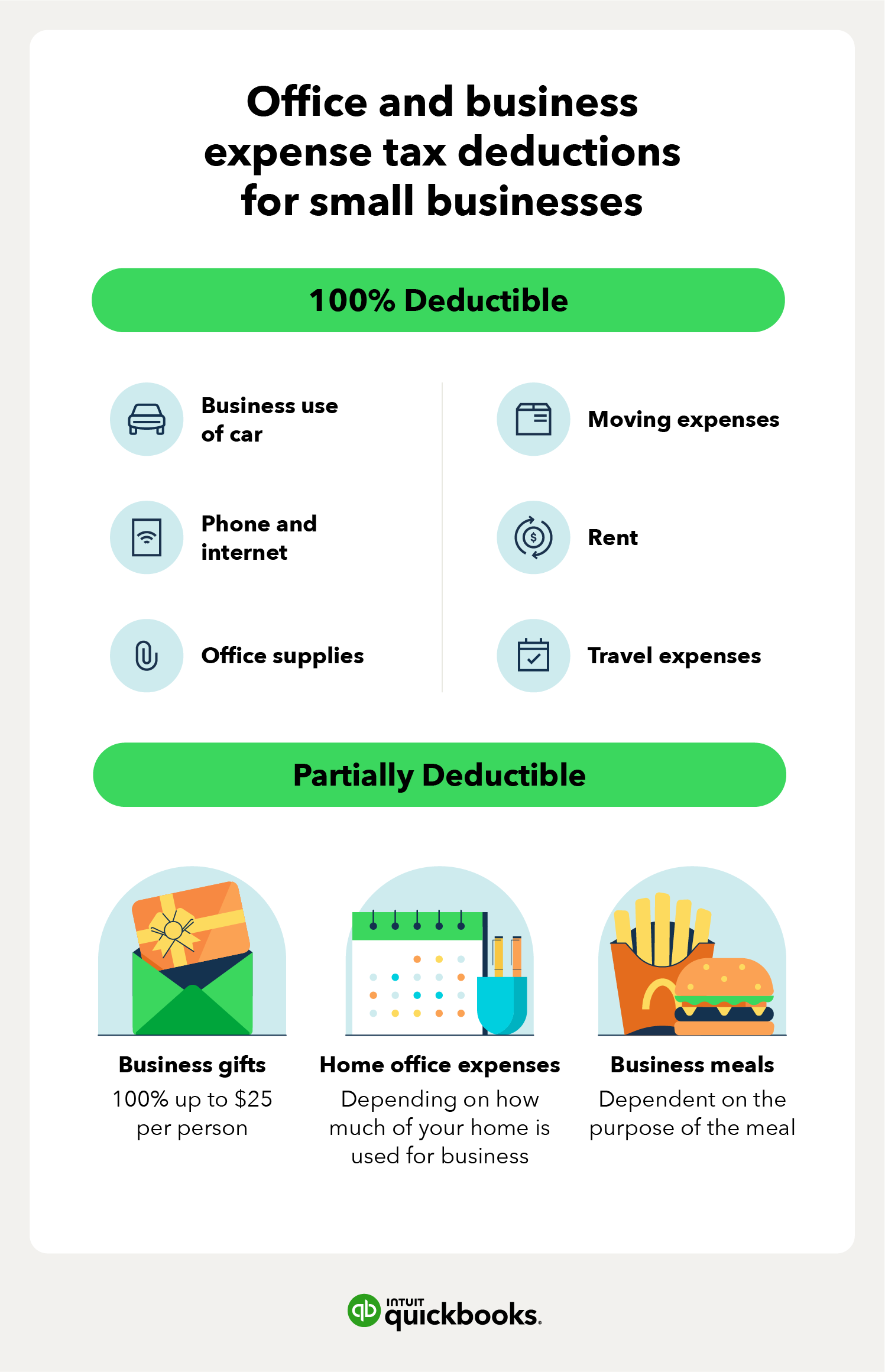

Source : turbotax.intuit.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comSelf Employed Tax Deductions Calculator 2023 2024 Intuit

Source : blog.turbotax.intuit.comtaxtonecpa is one of the best CPAs in the game and is finally

Source : www.instagram.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.com2024 Tax Write Offs for Self Employed Loan Brokers ARF Financial

Source : www.arffinancial.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comHome Office Deduction 2024 Self Employed Deduction 17 self employed tax deductions to lower your tax bill in 2023 : Margin loan rates from 5.83% to 6.83%. Under the current law, you can qualify for the home office deduction only if you’re self-employed. This wasn’t always the case, and these rules may not . Contractors who work from home are considered self-employed, and have access to many of the same tax deductions as small businesses — plus the addition of home office deductions. .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)